Last class, we discussed the value of celebrity brands and celebrity endorsement both historically and in the present moment within the wine and spirits industries. From the success of Invivo X by Sarah Jessica Parker to the sale of part-George Clooney owned Casamigos Tequila to Diageo for $1 billion in June 20171, it is clear that celebrity brand association can be immensely lucrative. However, we also discussed that celebrity involvement is often limited to affordable products that appeal to the broad range of consumers that make up celebrity fanbases. The data further suggest this. For example, Chateau Miraval Rosé (750ml), made on Brad Pitt and Angelina Jolie’s Côtes de Provence estate, retails for around $202; Diddy’s Ciroc Vodka (750ml) retails for around $303; and Ryan Reynolds’ Aviation Gin (750ml) retails for around $334. While these price points do not diminish the potential quality of these products and often reflect the average prices of their competitors in the marketplace, they seemingly suggest that celebrities cannot venture into the production of drinks with higher price points. As we thought about the likes of Kim Kardashian releasing their own alcohol brands last class, and many suggested that accessible pricing may be the best fit for celebrity brands, I wanted to highlight a celebrity-owned brand with pricier products that I think suggests the potential for a larger ultra-premium celebrity wine and spirits category.

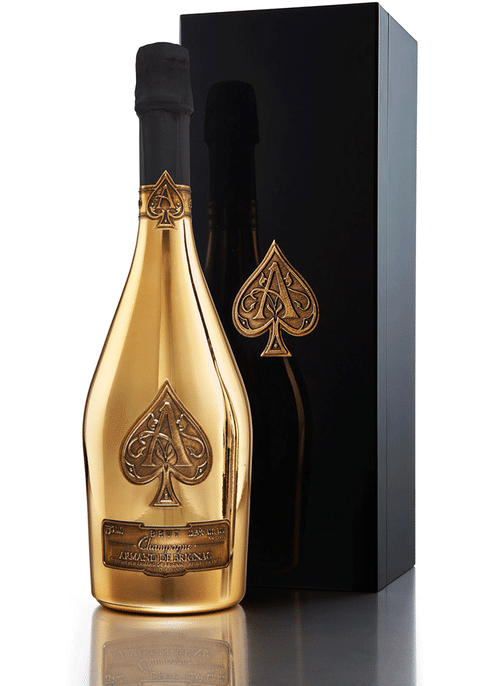

In 2014, Jay Z purchased Armand de Brignac Champagne, popularly known as “Ace of Spades,” from Sovereign Brands for an undisclosed amount5. This made the brand, according to one of the rapper’s own songs, the first 100% black-owned champagne6. It is made by the Cattier Champagne house, located in Chigny-les-Roses, a first growth village of the Montagne de Reims. The Cattier family has been making champagne over 13 generations7. The rapper is said to have become interested in the brand after Frederic Rouzaud, the manager of the company that owned Cristal champagne (a brand largely popularized by rappers like Jay Z), made seemingly racist remarks in May of 2006 and thus turned the rapper off from supporting Cristal ever again8. The Ace of Spades 750mL Brut Gold signature SKU retails for around $300 and is the brand’s cheapest offering9. While it is common for champagnes to have higher price tags than most other drinks, this is still a large number compared to other luxury brands (a Vintage 2008 750mL Dom Perignon retails for around $190)10. The brand has gained popularity in elite circles, largely due to its embrace by Hollywood heavyweights. Refusing to be seen promoting Moët, Beyoncé and Jay Z brought their own bottles of Ace of Spades to this year’s Golden Globes and placed in on their table, leading stars like Jennifer Aniston to post about it11. Reese Witherspoon loved it so much that she was subsequently sent cases of the champagne from Beyoncé and Jay Z12.

I have to admit, the marketing has worked on me. When I turned 21, I saved up to get a bottle of Brut Gold for the celebration, choosing its gorgeous packaging and association with superstars I admire over the Dom Perignons and Perrier-Jouets of the world. While some may argue that Ace of Spades is a singular case, I do believe that brands like this suggest the potential for other successful ultra-premium celebrity brands, especially for celebrities whose images largely revolve around lavish lifestyles. I’m curious to hear people’s thoughts.

Sidenote: The implications of multigenerational family winemaking on winemaker/winery owner diversity are disheartening. The fact about Jay Z being one of the first black owners, if not the first, of a champagne brand highlights a homogeneity that I feel must be addressed moving forward.

- https://www.thedrinksbusiness.com/2017/06/diageo-buys-george-clooneys-casamigos-tequila-for-1-billion/

- https://www.wine.com/search/miraval%20rose/0

- https://www.wine.com/product/ciroc-vodka/105342

- https://www.wine.com/product/aviation-gin/531748

- https://www.businessinsider.com/jay-z-buys-ace-of-spades-champagne-2014-11

- https://www.azlyrics.com/lyrics/jayz/familyfeud.html

- https://www.cattier.com/en/house/

- http://www.today.com/id/13350034/ns/today-today_entertainment/t/jay-z-launches-cristal-bubbly-boycott/#.Xlstpi2ZOCU

- https://www.wine.com/product/armand-de-brignac-ace-of-spades-brut-gold-with-gift-box/91199?state=CA&s=GoogleBase_CSE_91199_type_Wine_Champagne_Non-Vintage_209&utm_source=google&utm_medium=cpc&utm_term=&utm_campaign=Google_Shopping_CA_Smart&showpromo=true&promo=PSCASE10&gclsrc=aw.ds&gclid=EAIaIQobChMI9vi53Jr45wIVFqrsCh3EIAOEEAYYASABEgLwq_D_BwE#

- https://www.wine.com/search/armand%20de%20brignac/0

- https://www.wine.com/list/wine/dom-perignon/7155-8757

- https://vinepair.com/booze-news/beyonce-jay-z-champagne-golden-globes/

- https://www.harpersbazaar.com/celebrity/latest/a30469494/jay-z-and-beyonce-sent-reese-witherspoon-case-champagne/